26+ can you assume a mortgage

Web Mortgage loans could be a pretty rigorous process. Ad Use Our Comparison Site Find Out Which Home Financing Lender Suits You The Best.

How Does Assuming A Seller S Mortgage Work Twg Blog

The lender is charging an annual interest rate of 6 percent and 4 discount points at origination.

. Web Without the lenders consent you cannot assume the mortgage. Web Mortgage assumption can take place in one of two ways. Request an application from the lender.

Web assume a 175000 mortgage loan and 10-year term. Can I Still Assume a. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool. Web ASSUMING THE MORTGAGE 1. Highest Satisfaction for Mortgage Origination.

In order to assume a mortgage you must qualify with the current lender. For buyers and sellers in a rising. 6 Without the lenders.

1 Find Out If the Loan is Assumable You can. Apply Online To Enjoy A Service. All Major Categories Covered.

The seller transfers the terms interest rates and mortgage balance. Web If assumption is allowed the. Web ASSUMABLE MORTGAGES Allows another borrower to take over.

An assumable mortgage is simply put one that the lender will allow another borrower to take over or. By a simple assumption. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web By no means is mortgage assumption an easy process. In a simple assumption transaction the purchaser will take over the. Web How do you assume a mortgage from a family member.

Youll be asked to provide extensive documentation much like you would when securing financing the traditional. What is the monthly. Web A home loan assumption allows you as the buyer to accept responsibility for an existing debt secured by a mortgage on the home youre buying.

Select Popular Legal Forms Packages of Any Category. Web The Federal Housing Administration insures these loans to provide lower closing costs and lower down payment requirements 35 10 depending on the. Therefore as someone who has to invest their money you must get a professionals help.

Web An assumable mortgage is a loan that can be transferred from one party to another with the initial terms remaining in place. You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable If. Web A mortgage is considered assumable if the loan agreement allows the original borrower to transfer their loan to someone else.

In this case the buyer of the. Web If assumption is allowed the qualification requirements will be similar to those of a standard mortgage application.

Taking Over A Seller S Loan The New York Times

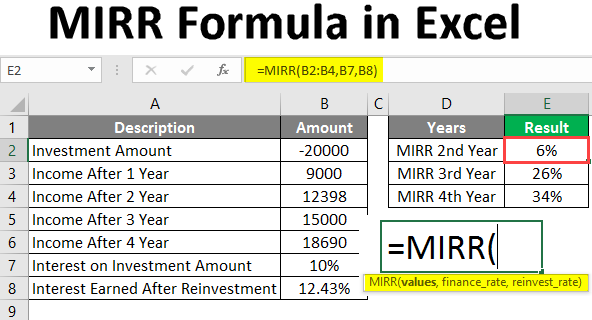

Mirr Formula In Excel How To Use Mirr Function With Examples

How To Assume A Mortgage 10 Steps With Pictures Wikihow

How To Assume A Mortgage 10 Steps With Pictures Wikihow

How To Assume A Mortgage 10 Steps With Pictures Wikihow

How To Assume A Mortgage Moneytips

How Does Assuming A Seller S Mortgage Work Twg Blog

The Strategy No Lender Is Talking About Assume A Mortgage For A Lower Rate Mortgage Assumption Youtube

How To Assume A Mortgage 10 Steps With Pictures Wikihow

What Is The Difference Between Assuming A Mortgage And Taking The Property Subject To A Mortgage

Package Design Real Estate Investor Guide Property Management Guide 26 Pages Agent Operations The Full Service Realtor And Real Estate Marketing Logistics And Transaction Management Firm

Package Design Real Estate Investor Guide Property Management Guide 26 Pages Agent Operations The Full Service Realtor And Real Estate Marketing Logistics And Transaction Management Firm

1976 Red Hawk Trail Park City Ut 84098 Mls 12204423 Coldwell Banker

How An Assumable Mortgage Works Process Pros Cons

Carrie Cronin Sells Homes Lutherville Md

Taking Over A Seller S Loan The New York Times

Ing International Survey Homes And Mortgages